Featured Companies

KiOR, KIOR, Profile, Summary

KiOR | KIOR | Profile | Summary

KiOR is a next-generation renewable fuels company that has developed a proprietary technology platform to convert biomass into renewable crude oil that is processed into gasoline, diesel and fuel oil blendstocks. The company built the first commercial scale cellulosic fuel facility in Columbus, MS, which started production in 2012. KiOR strives to help ease dependence on foreign oil, reduce lifecycle greenhouse gas emissions and create high-quality jobs and economic benefit across rural communities.

Key differentiating factors about KiOR include:

-

Breakthrough technology that leverages proven process

-

Ability to use of abundant non-food feedstocks

-

Access to a vast global market and large base of customers

-

Experienced management team that can deliver accelerated growth.

Technology

KiOR has developed a proprietary technology platform to convert sustainable, low-

|

|

cost, non-food biomass into a hydrocarbon-based renewable crude oil. Using standard refining equipment, the company processes its renewable crude into gasoline and diesel blendstocks that can utilize the existing transportation fuel infrastructure for use in vehicles on the road today.

In essence, KiOR’s technology simply reduces the time it takes to produce oil from millions of years to a matter of seconds. The company’s technology platform combines its proprietary catalyst systems with a process based on existing Fluid Catalytic Cracking (FCC) technology, a standard process used for over 60 years in oil refining. The efficiency of KiOR’s process, called Biomass Fluid Catalytic Cracking (BFCC), and the proven nature of catalytic cracking technologies allow for significant cost advantages, including lower capital and operating costs, versus traditional biofuels producers.

KiOR processes its renewable crude oil in a conventional hydrotreater, which is a standard process unit used in oil refineries, into gasoline and diesel blendstocks that can be combined with existing fossil-based fuels and used in vehicles on the road today.

Products

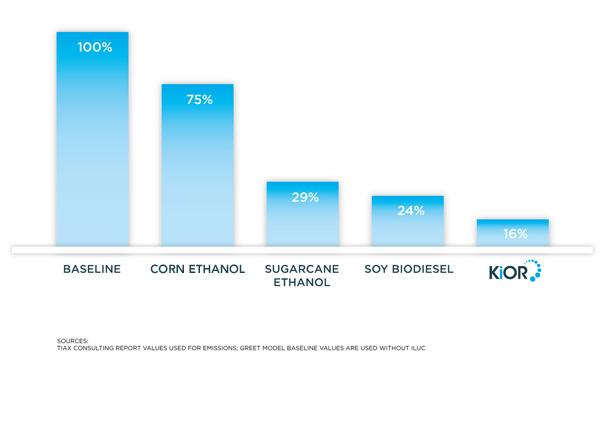

KiOR produces renewable gasoline and diesel blendstocks that are comparable to their fossil-fuel based counterparts and can easily be dropped-in to the existing fuel supply, offering a more environmentally friendly fuel option to consumers at the pump. According to a full lifecycle emissions analysis of KiOR data, based on the Argonne National Laboratory's Greenhouse Gases, Regulated Emissions and Energy Use in Transportation, or GREET model, using KiOR'sdata, KiOR’s gasoline and diesel blendstocks are projected to reduce direct lifecycle greenhouse gas emissions by more than 80% compared to fossil-based gasoline and diesel.

Given the infrastructure compatibility of its renewable fuels, KiOR expects to access the $2 trillion global transportation fuels market while also benefiting from government programs, such as the US Renewable Fuel Standard.

KiOR’s renewable blendstocks can be combined with conventional gasoline and diesel fuels by refiners and oil companies and sold to distributors of finished products, or end users of fuel products. To date, KiOR has signed fuel offtake agreements with Hunt Refining, Catchlight Energy, and FedEx Corporate Services, thus demonstrating its ability to fulfill the needs of a variety of customers.

Greenhouse Gas Reductions

While KiOR’s blendstocks are comparable to their fossil fuel-based counterparts, because they are made from renewable biomass, they can contribute to significant reductions in carbon emissions. In fact, on a full lifecycle basis, KiOR’s gasoline and diesel blendstocks are projected to reduce greenhouse gas emissions by over 80% compared to the fossil-based fuels they displace, according to an analysis of KiOR data by TIAX LLC.

Sources: The Company, OxBridge Research, OTCKING, DailyStockDeals, OTCstockIQ

Don't miss the NEXT premium Alert! Sign-up, Get Alerts,MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you want to get your company profiled or have questions/comments, please don't hesitate to contact the Editor [@] OxBridgeResearch.com

ZaZa Energy , ZAZA, Profile, Summary

ZaZa Energy , ZAZA, Profile, Summary

ZaZa Energy Overview

CONSOLIDATING A DOMINANT POSITION IN THE EAGLEBINE

>High concentration of liquid rich assets in the Eaglebine and Eagle Ford trends

> ~110,000 acre presence within the Eaglebine and Lower Cretaceous window

> 7,600 acres surrounded by Devon’s recently acquired $6 billion GeoSouthern Eagle Ford assets

> Completed amendment to Eaglebine/Eagle Ford East joint venture agreement with large independent operator

> Accelerated timing

> Contiguous JV acreage footprint

> Immediate liquidity (~$17.8MM net cash) and production (~$17MM in PDP value)

> 6 well carry program

> Proven management team

> Significant experience with majors and large independents

> Collectively participated in the drilling and completion of over 5,500 wells

UNCONVENTIONAL ASSETS – POST CONVENTIONAL THINKING

MILESTONES - POSITIONED FOR RAPID VALUE CREATION-

> Secured a first mover advantage in the Eaglebine/Eagle Ford East play

> Consummated joint venture agreement with a large independent operator to develop Eaglebine/Eagle Ford East acreage

> Accelerated original joint venture agreement through an amendment to acquire additional production and further develop our acreage block

> Entered joint venture agreement with Sabine Oil & Gas LLC, a First Reserve portfolio company, to develop Sweet Home Eagle Ford acreage

> Strategically completed sale of non core Moulton Eagle Ford assets for approximately $38 million

> Reduced senior secured notes to $26.8 million from $100 million

> Drilled and completed 4 proof?of?concept wells during 2013

EAGLE FORD SHALE PROPERTIES

JOIN VENTURE

SWEET HOMEPROSPECT

PROVEN BUSINESS MODEL

Initial Appraisal

Proof of Concept

Capital Markets Access

Proven Management Team

Todd Brooks (Founder, Executive Director, President &

CEO)

Ian Fay (CFO)

Kevin Schepel (EVP Exploration and Production)

Thomas Bowman (EVP Evaluation, Geology and Geophysics)

The Advantage

Approach

Results

Sources: The Company, OxBridge Research, OTCKING, DailyStockDeals, OTCstockIQ

Don't miss the NEXT premium Alert! Sign-up, Get Alerts,MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you want to get your company profiled or have questions/comments, please don't hesitate to contact the Editor [@] OxBridgeResearch.com

The Alkaline Water Company, WTER, Profile

The Alkaline Water Company | WTER | Profile

![]()

The Alkaline Water Company employs a state-of-the-art Electrochemically Activated Water (ECA) system to create 8.8 pH drinking water without the use of any chemicals. The ECA process uses specialized electronic cells coated with a variety of rare earth minerals to produce scientifically engineered water.The Company further incorporate 84 trace Himalayan minerals considered to be the best in the world.

Waternomics

-

A typical American drinks about 10 cases of bottled water a year.

-

In 2011, total bottled water sales in the U.S. hit 9.1 billion gallons — 29.2 gallons of bottled water per person, according to sales figures from Beverage Marketing Corp.

-

The 2011 numbers are the highest total volume of bottled water ever sold in the U.S., and also the highest per-person volume.

-

Bottled water sales aren’t just growing —they’re booming. Volume increased by 4.1 percent in 2011 —five times as fast as the 0.9 percent growth in the sales of beverages overall, according to Beverage Marketing. Bottled water sales, in fact, are growing twice as fast as the economy itself.

-

The U.S Market is predicted to double in in the next two years.

Water is the new front:

Old Rivals Pepsi & Coke fighting for market share

-

The three global giants in the industry Coca Cola and Pepsi and Nestle

-

Pepsi’s Aquafina, introduced in 1997, is now the number one branded non-carbonated bottled water in the US.

-

Coke’s Dasani, launched a few months later, is second in the category. Both are likely to lead the market in the future.

-

Market analysts look for major consolidation among the plethora of brands in the next few years.

-

It is anticipated that large national marketers will buy local brands around the country and shut them down. Why? To reduce competition and, in some cases, to acquire other supply sources for spring water.

-

The battle between Coke and Pepsi and the larger European brands is the “high profile war that will be waged,” predicts at least one industry insider, who adds that branding will remain a deciding factor for discerning consumers. “Quality and trust are going to be critical, so brands will be important.”

The Opportunity

Virtually no competitive products sized larger than 1.5 L in the market.

-

Consumer acceptance for Alkaline water continues to grow significantly due to its many perceived health benefits, making it the water of choice.

-

Bulk Alkaline water can be marketed at a consumer price point significantly less, per ounce, than existing brands.

-

There is a high demand amongst major retailers for bulk alkaline waters.

-

New bulk size option well received by existing consumers of alkaline water.

Sources: The company, OxBridge Research, OTCKING, DailyStockDeals, OTCstockIQ

Don't miss the NEXT premium Alert! Sign-up, Get Alerts,MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you want to get your company profiled or have questions/comments, please don't hesitate to contact the Editor [@] OxBridgeResearch.com

Hemispherx Biopharma, HEB, Profile, Summary

Hemispherx Biopharma, HEB, Profile, Summary

Hemispherx Biopharma, HEB, is a biopharmaceutical company dedicated to treating and preventing chronic viral and immune-based disorders through the development and manufacturing of compounds that enhance the natural immune system of the human body. Hemispherx Biopharma, has developed over nearly three decades a vast body of knowledge relating to a potentially new class of pharmaceutical products (nucleic acid compounds) that are designed to activate otherwise dormant cellular defenses against viruses and tumors.

The Company’s flagship products include Alferon N Injection® and the experimental immunotherapeutics Ampligen®. Its platform technology includes large and small agents for potential treatment of various chronic viral infections.

Ampligen®, is a new class of specifically-configured ribonucleic acid (RNA) compounds targeted at such important diseases as Chronic Fatigue Syndrome/Myalgic Encephalomyelitis (CFS/ME), HIV, Hepatitis B, Hepatitis C, and cancers including kidney cancer and metastatic malignant melanoma.

Alferon N Injection® (interferon alfa-n3, human leukocyte derived) is a highly purified, natural source, glycosylated, multi-species alpha interferon product, composed of eight forms of high-purified alpha interferon. It is the only natural source, multi-species alfa interferon currently sold in the United States and is also approved for sale Argentina. Alferon N Injection® is the company’s registered trademark for it’s injectible formulation or natural alpha interferon approved by the FDA for the treatment of genital HPV (refractory condylomata acuminata). Alferon N Injection® may also have activity against other viral infections such as Multiple Sclerosis, Hepatitis C, HIV, West Nile Virus, and SARS, but has not been approved for that use.

Ampligen®

Ampligen®, the company's lead compound addresses a variety of chronic diseases and viral disorders. Ampligen® drugs for several viral disorders are under development. More than 40,000 doses at over 20 U.S. clinical trial sites have been delivered with Ampligen®.

ALFERON N Injection®

ALFERON N Injection® [Interferon alfa-n3 (human leukocyte derived)] is the Company's registered trademark for its injectable formulation of Natural Alpha Interferon, approved by the U.S. Food and Drug Administration (FDA) for the intralesional treatment of refractory or recurring external condylomata acuminata in patients 18 years of age or older.

ALFERON N Injection® is the only highly purified, natural-source, multispecies alpha interferon product currently sold in the U.S. and is also approved for sale in Argentina.

Clinically Effective:

-

All warts disappeared in 54% of patients.3

-

No recurrence in 76% of complete responders at follow-up.3

-

Completely cleared 73% of all treated warts.3,4

-

No human antibodies to interferon alfa-n3 detected in clinical trails.3,4

-

Provides a spectrum of multiple alpha interferon subtypes.1,2

Well-tolerated

-

No surgery or caustics and resultant ulceration or scarring.

-

No specific post-treatment care necessary.4

-

The most common adverse effects (mild to moderate, transient flu-like symptoms) were comparable to placebo after 304 weeks of therapy.3.4

-

The majority of patients considered Alferon N Injection preferable to conventional therapy. 3.4

Please see the package insert for prescribing information.

Alferon Low Dose Oral (LDO)®

Alferon LDO®, Hemispherx's oral form of Our Anferon N product (Low Dose Oral Interferon Alfa-N3, Human Leukocyte Derived), which is a new delivery form of our FDA approved drug, Alferon N® is the only natural interferon currently FDA approved and available in the marketplace. Hemispherx has initiated clinical trials as part of an accelerated evaluation of the experimental bio-therapeutic Alferon LDO (Low Dose Oral Interferon Alfa-n3 (Human Leukocyte Derived)) as a potential new experimental therapy for Avian Flu and other lethal viral diseases, which have high acute death rates. Clinical trials in human volunteers (being conducted in both the U.S. at Drexel University, Philadelphia, and shortly to commence in Hong Kong at the Princess Margaret Hospital) are designed to determine whether Alferon N, delivered in a new, experimental oral drug delivery format, can resuscitate the broad-spectrum antiviral and immunostimulatory genes. These human genes are shut down by acute lethal viral infections such as avian flu and smallpox

Sources: The Company, OxBridge Research, Daily Stock Deals, Penny Stock Monster, OTC King

Don't miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you want to get your company profiled or have questions/comments, please don't hesitate to contact the Editor [@ ] OxBridgeResearch.com

HPV, HIV, Chronic Fatigue Syndrome (CFS), Hepatitis, influenza, H5N1, H7N9, avian influenza, drug resistant avian influenza, Hepatitis A, viral, bacterial, viral infections, Multiple Sclerosis, Hepatitis C, West Nile Virus, SARS, FDA. CIDC.

Feed Entries

Feed Entries